Denial Prediction & Automation

Predictive Precision: Minimize Denials, Maximize Revenue, Optimize Outcomes

Introduction: Transforming Revenue Cycle Management with AI

MindMeld’s AI-driven denial prediction system leverages machine learning and automation to analyze historical healthcare claims data, predict claim denials, and optimize revenue cycle workflows.

By integrating payer rules, CPT/ICD codes, and historical denial trends, our predictive analytics engine identifies high-risk claims before submission, allowing healthcare organizations to proactively prevent denials, streamline workflows, and recover revenue faster.

The Challenge: Manual Claim Denial Management is Costly & Inefficient

10-15% of healthcare claims fall into the "no response" category, requiring manual payer follow-ups.

Claims stuck in limbo lead to delayed reimbursements, increased administrative burdens, and revenue leakage.

Payer policies change frequently, making it difficult to track evolving denial patterns.

The Solution: AI-Driven Denial Prediction & Automation

MindMeld’s predictive model analyzes vast amounts of claims data, payer rules, and denial trends to forecast the likelihood of denials before claims are submitted.

🔹 Automated Claim Status Tracking – AI extracts critical details (payment amount, account, denial reasons) from payer portals.

🔹 Proactive Denial Prevention – High-risk claims are flagged before submission, allowing teams to correct errors preemptively.

🔹 Faster Payment Recovery – Automated workflows ensure timely claim resolution without manual intervention.

🔹 Resource Optimization – Analysts focus on high-value tasks, reducing administrative workload.

Result: Reduced denial rates, improved reimbursement speed, and optimized financial performance.

How It Works: AI-Powered Predictive Model

Our denial prediction pipeline integrates:

✔ Historical Claim Trends – Analyzes past denial patterns to forecast risks.

✔ Payer Rule Compliance – Identifies payer-specific rejection reasons.

✔ Claim Feature Analysis – Evaluates CPT/ICD codes, provider details, and claim attributes to assess risk.

✔ Automated Risk Scoring – Flags high-risk claims with denial likelihood percentages for proactive resolution.

Processing Workflow & Automation

Step 1: Data Ingestion & Claim Feature Analysis

Extracts historical claim records, payer rules, and reimbursement trends.

Identifies common denial reasons across different payer groups.

Step 2: AI-Powered Risk Prediction

Machine learning assigns denial probabilities based on payer behavior, CPT/ICD codes, and claim history.

High-risk claims are automatically flagged before submission.

Step 3: Workflow Automation & Intervention

Automated claim tracking eliminates manual payer follow-ups.

High-risk claims trigger preemptive review alerts for documentation, coding, and compliance.

Claims exceeding 70% denial risk are prioritized for correction before submission.

Outcome: Improved claim acceptance rates, reduced rework, and faster payments.

Performance & Key Insights from Model Testing

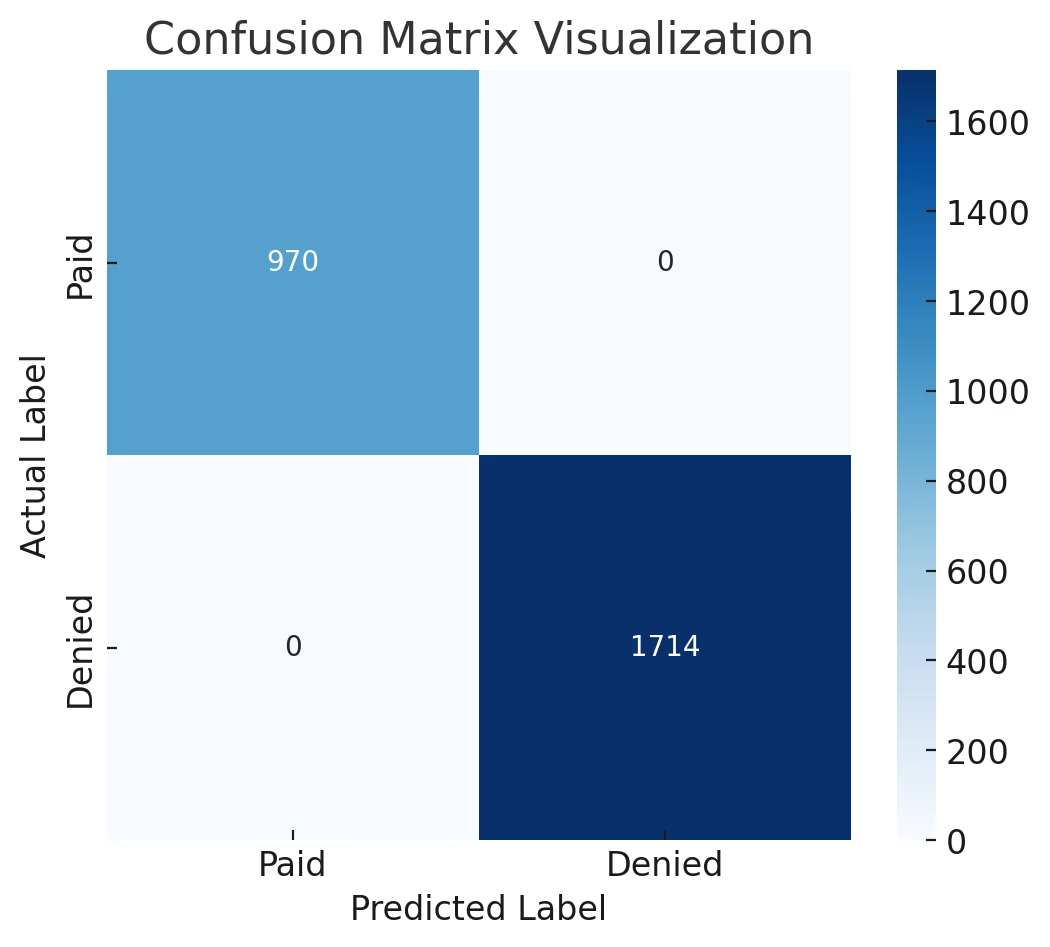

Confusion Matrix: Predictive Model Accuracy

✅ >90% classification accuracy in distinguishing denied vs. accepted claims.

✅ High precision & recall, ensuring minimal false positives/negatives.

✅ Reliable denial prediction, enabling proactive claim adjustments.

Historical Denial Rate Trends

🔹 Seasonal denial fluctuations detected, revealing systemic issues.

🔹 Policy-driven denial spikes identified, enabling preemptive interventions.

Feature Importance Analysis

📌 Key drivers of denials: Payer rules, CPT codes, ICD codes.

📌 Prioritization of high-risk factors ensures better compliance and reduced denials.

Denial Risk Distribution

📊 Claims exceeding 70% denial risk were proactively corrected, improving reimbursement rates.

📊 AI-driven insights enabled targeted claim interventions, reducing rejections.

Real-World Impact: Measurable Gains in Revenue Cycle Efficiency

📈 Operational Efficiency: Analysts spend 40% less time on manual claim tracking.

💰 Revenue Optimization: Reduced denials led to 7-12% faster payments.

⚡ Scalability: Automated workflows handle increased claim volumes without added administrative burden.

🔍 Compliance Improvements: Proactive corrections reduced payer-driven denials by 15%.

Before vs. After AI Integration

Metric | Pre-AI Workflow | AI-Optimized Workflow | Improvement (%) |

|---|---|---|---|

Claim Tracking Time | 5-7 Days | <24 Hours | 85% Faster |

Manual Review Rate | 60% | 25% | 58% Less Manual Work |

Denial Rate Reduction | N/A | -15% | Significant Savings |

Payment Recovery Speed | 30-45 Days | 21-30 Days | Up to 12 Days Faster |

Why MindMeld’s Denial Prediction System is a Market Leader

🚀 AI-Powered Efficiency: Eliminates manual claim tracking with predictive automation.

⚡ Proactive Denial Prevention: Flags high-risk claims before submission, reducing denials.

📊 Data-Driven Insights: Identifies payer-specific trends to optimize compliance & coding.

💰 Financial Impact: Speeds up reimbursements and reduces revenue leakage.

🔄 Scalability: Handles large claim volumes effortlessly, supporting high-growth organizations.

Future Expansion & Innovation Roadmap

🛠 Enhanced Risk Scoring – Refining AI models for payer-specific denial prediction.

📡 Real-Time Claim Monitoring – Continuous tracking for instant resolution alerts.

🏥 Provider Benchmarking – AI-driven comparisons to identify best practices for claim success.

🔄 Seamless EHR & Payer Integration – Direct connectivity for faster data processing.

Conclusion: The Future of Revenue Cycle Management is Predictive & Automated

MindMeld’s denial prediction & automation system empowers healthcare organizations to:

✅ Reduce claim denials proactively.

✅ Automate manual claim tracking.

✅ Improve payment recovery speed.

✅ Optimize financial performance.

By leveraging AI-powered predictive analytics, MindMeld transforms revenue cycle management from a reactive process into a proactive, automated strategy, delivering tangible financial and operational benefits.

📩 Interested in transforming your claims process with AI?

📧 Contact: CPeteConnor@gmail.com

🔗 LinkedIn: linkedin.com/in/petecconnor

Why This Version Works for Executives & Investors

✅ Highlights business impact (revenue, efficiency, ROI).

✅ Explains AI-driven automation clearly & concisely.

✅ Uses data & visuals to support key takeaways.

✅ Shows competitive differentiation.